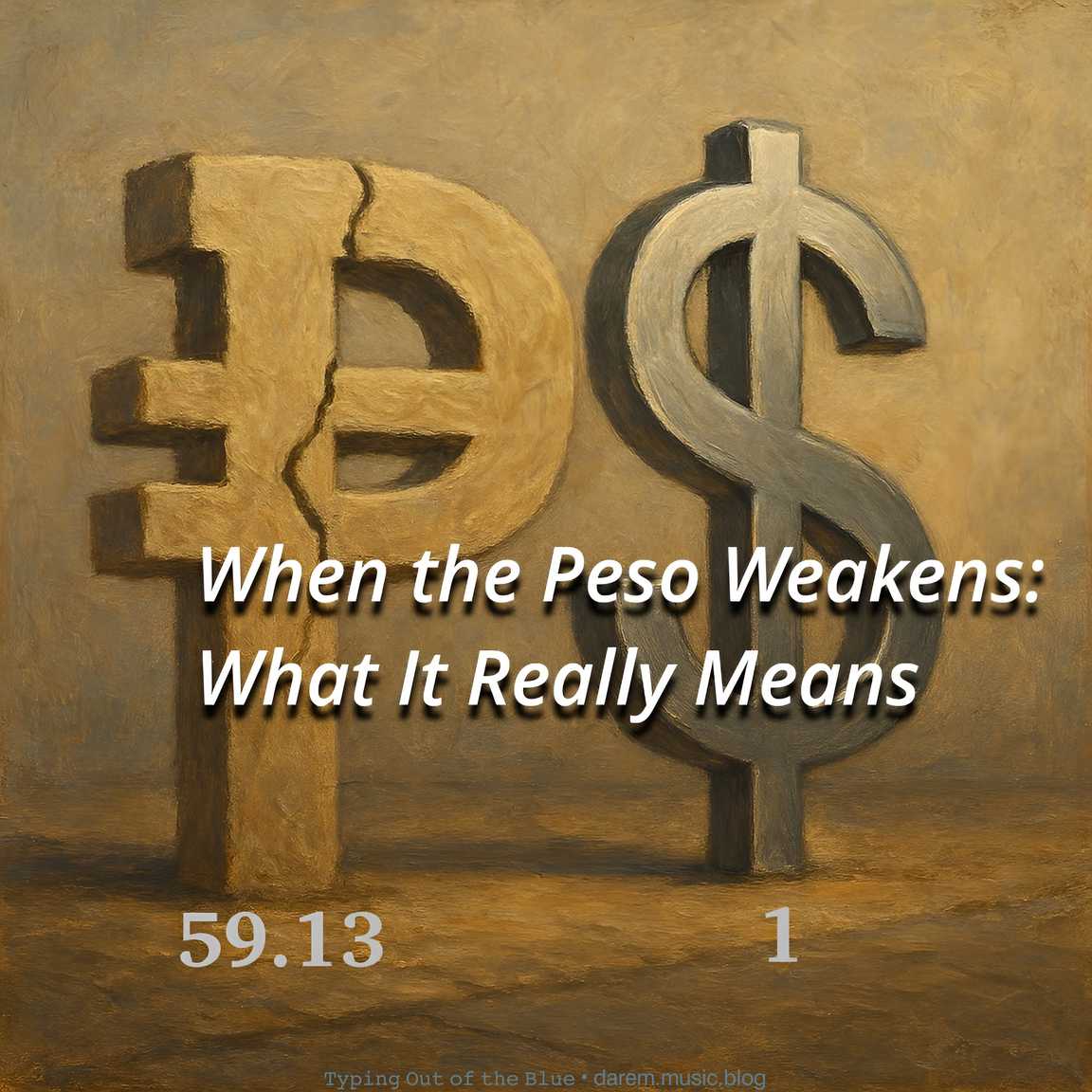

October 28, 2025—The Philippine peso closed at ₱59.13 against the US dollar today—its weakest value in history based on Bangko Sentral ng Pilipinas (BSP) data. Some people online disagree, saying it already hit ₱60.66 before. But that number came only from foreign market trackers, not from the BSP.

According to official BSP records, the peso’s rate in November 2022 ranged between ₱57.35 and ₱58.55 per dollar. It never crossed ₱60. That’s why today’s ₱59.13 is officially the weakest peso on record.

So what does this actually mean for ordinary people and the country’s economy?

✅ When the Peso Falls but Helps

• Exports gain – Philippine goods become cheaper abroad, bringing in more dollars.

• Tourism grows – Foreign visitors get more value for their money. Local businesses benefit.

• Local industries move – Imports cost more, so more companies start buying local.

• OFW families earn more – Each dollar remitted home now converts to more pesos.

• Investors see opportunity – A weaker peso can attract foreign investors since running a business here becomes more affordable.

⚠️ When the Fall Hurts

• Imports cost more – Fuel, medicine, and gadgets get pricier since they’re paid in dollars.

• Prices rise – Inflation hits, making daily life tighter.

• Peso loses power – Same cash, fewer groceries.

• Dollar debts hurt – The government and companies pay more pesos for the same loans.

• Businesses face uncertainty – Rapid changes in the exchange rate make it hard to plan and keep prices steady.

💡

A weak peso isn’t just bad—it’s a message. It tells us to depend less on imports and to build more at home. The peso may have fallen, but it’s also a reminder to rise in smarter ways.

⌨ ᴛʸᵖⁱⁿᵍ ᴏᵘᵗ ᵒᶠ ᵗʰᵉ ʙˡᵘᵉ ᵈᵃʳᵉᵐ ᵐᵘˢⁱᶜ ᵇˡᵒᵍ